Bank of Canada Summary June 2023

Expect the Unexpected!

There was considerable debate leading up to the Bank of Canada’s latest interest rate announcement. Some economists felt Canada’s central bank would have no choice but to raise rates after the economy grew well above expectations in the first quarter. Most bet the Bank would hold rates steady, at least until later this summer or fall:

- 24 of 28 economists expected no change for Wednesday's BoC meeting.

- Two-thirds expected no further overnight rate changes at all this year.

- The market had priced in a 59% chance of no hike

Unfortunately, the market and leading economists were WRONG.

The Bank of Canada raised its overnight interest rate +0.25%. This will directly impact the Prime lending rate and variable rate products specifically.

- Variable rate mortgage payments will increase ~$15/month per $100k of mortgage on average.

- Bond yields, which directly impact fixed rate mortgages, are up considerably in recent weeks indicating markets believe rates will remain higher for longer.

Further takeaways from today’s BoC Announcement

- "...Underlying inflation remains stubbornly high."

- Three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

- "Consumption growth was surprisingly strong and broad-based..."

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- "...Housing market activity has picked up..."

- "The labour market remains tight."

- Higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- "CPI inflation ticked up in April to 4.4%..."

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

Where do we go from here?

Tiff Macklem and company have expressed dissatisfaction with the prevailing conditions. The economy exhibits higher-than-anticipated growth, accompanied by a resurgence in inflation and a stronger-than-expected labor market. While resilience is generally regarded as positive, it does not align with the objectives of the BoC. Consequently, the decision was made to raise interest rates further.

Notable inflection points in the chart align with significant events such as the collapse of Silicon Valley Bank in March, stronger-than-anticipated American inflation and employment in February, and the BoC's conditional pause announcement in January.

The chart above depicts the 5-year Canadian Government Bond's trajectory over the past year, serving as an indicator of future fixed rates. It shows fluctuations corresponding to turning points in market expectations, with the current trend pointing towards a peak due to increased inflation and GDP figures. The recent rate hike has further elevated this peak.

The upcoming BoC meeting, scheduled in five weeks, will be influenced by further data, including employment and inflation figures, as well as preliminary assessments of April's GDP. While it is unlikely to be a solitary rate increase, the decision will be influenced by this data, potentially leading to additional hikes in July or September.

The

desired outcome is a consistent and sustainable decline in inflation, growth, and employment trends, which would result in a more stable decline in bond yields instead of the current roller coaster pattern.

New Paragraph

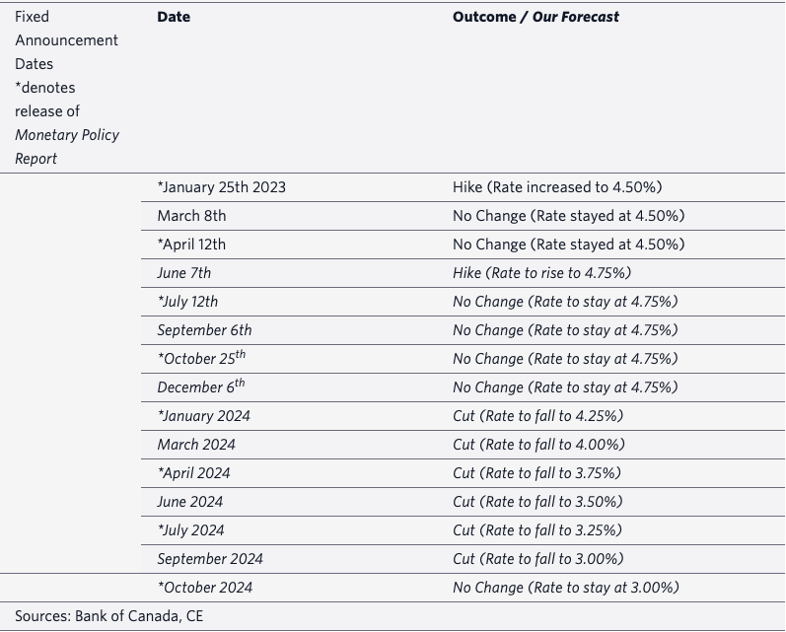

Capital Economics provides the chart above indicating their expectations for future BoC actions, and their accurate prediction of the recent rate hike grants them credibility. They anticipate a cumulative 1.25% reduction in the overnight rate over the next year, starting in January. Following this hike, shorter-term fixed rates are projected to hover around 5.5% with minor fluctuations, offering a relatively stable path for those seeking stability amidst market volatility.

Despite the current market turbulence and elevated stress levels, it is widely accepted that economic data will eventually align with the goals of central banks in the latter half of the year. This alignment is expected to lead to decreased bond yields, and therefore reduced mortgage rates.

It should be noted that the BoC continues with its mantra “remaining resolute in its commitment to restoring price stability for Canadians.”

If you have any questions or concerns with regards to mortgage rates, payments, or cashflow strategies, we are here to help! Reach out to your Nest Mortgage Specialist and review your options today!

July 12, 2023 is the Bank’s next scheduled policy interest rate announcement.

Contributors: Scott Gingles, Ray Macklem, www.capitaleconomics.comNew Paragraph