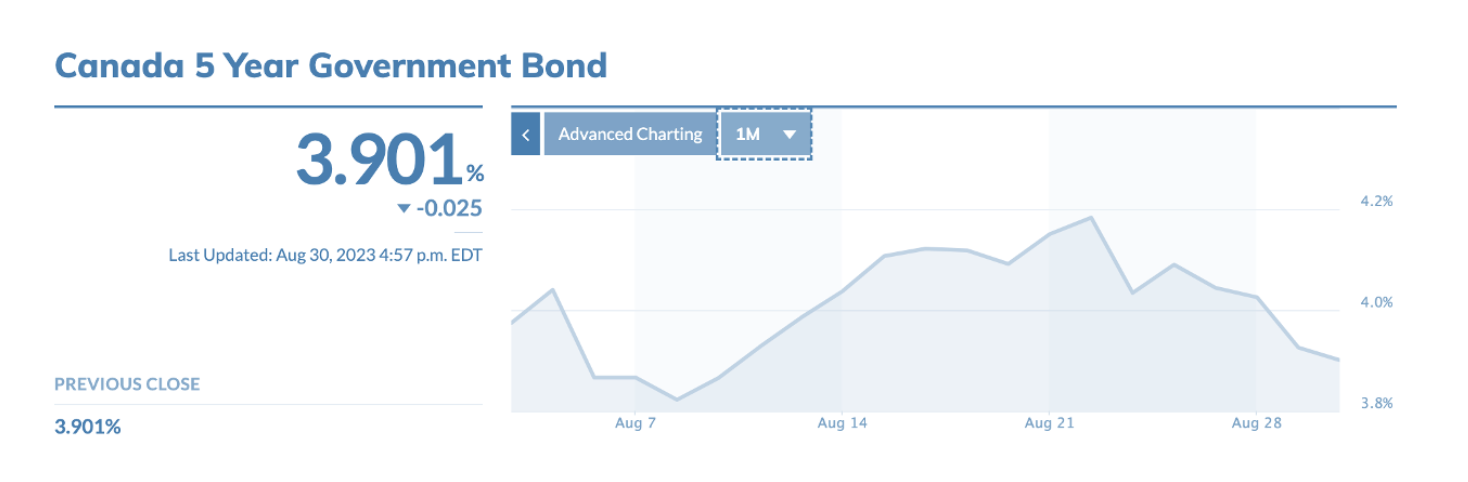

Positive Shift in Bond Yields

Following weeks of surging rates, Canadian bond yields (which directed impact fixed mortgage rates) have retracted below the 4% threshold, shedding 26 basis points from the previous week's 16-year peak — a potentially temporary but welcome development.

In the next two weeks the bond market will be further influenced by the following macroeconomic updates:

- Canadian employment figures

- Canadian GDP data

- U.S. Personal Consumption Expenditures (PCE)

- U.S. employment indicators

As reported earlier this month, July's inflation was up from 2.8% the previous month to 3.3%. CPI is still well above target (2%), which has added unwelcome pressure to yields and fixed rates. The BoC’s benchmark rate currently stands at a 22-year high of 5.00% as the battle against inflation continues.

Recent predictions on what the Bank of Canada will announce Sept 6th have been mixed. The near-term options are to either increase or pause, as the consensus is a decrease won’t materialize until late 2024 at the earliest. Most experts agree that a pause is in order for the next rate announcement, but a final increase by year-end is widely expected by the market in general.

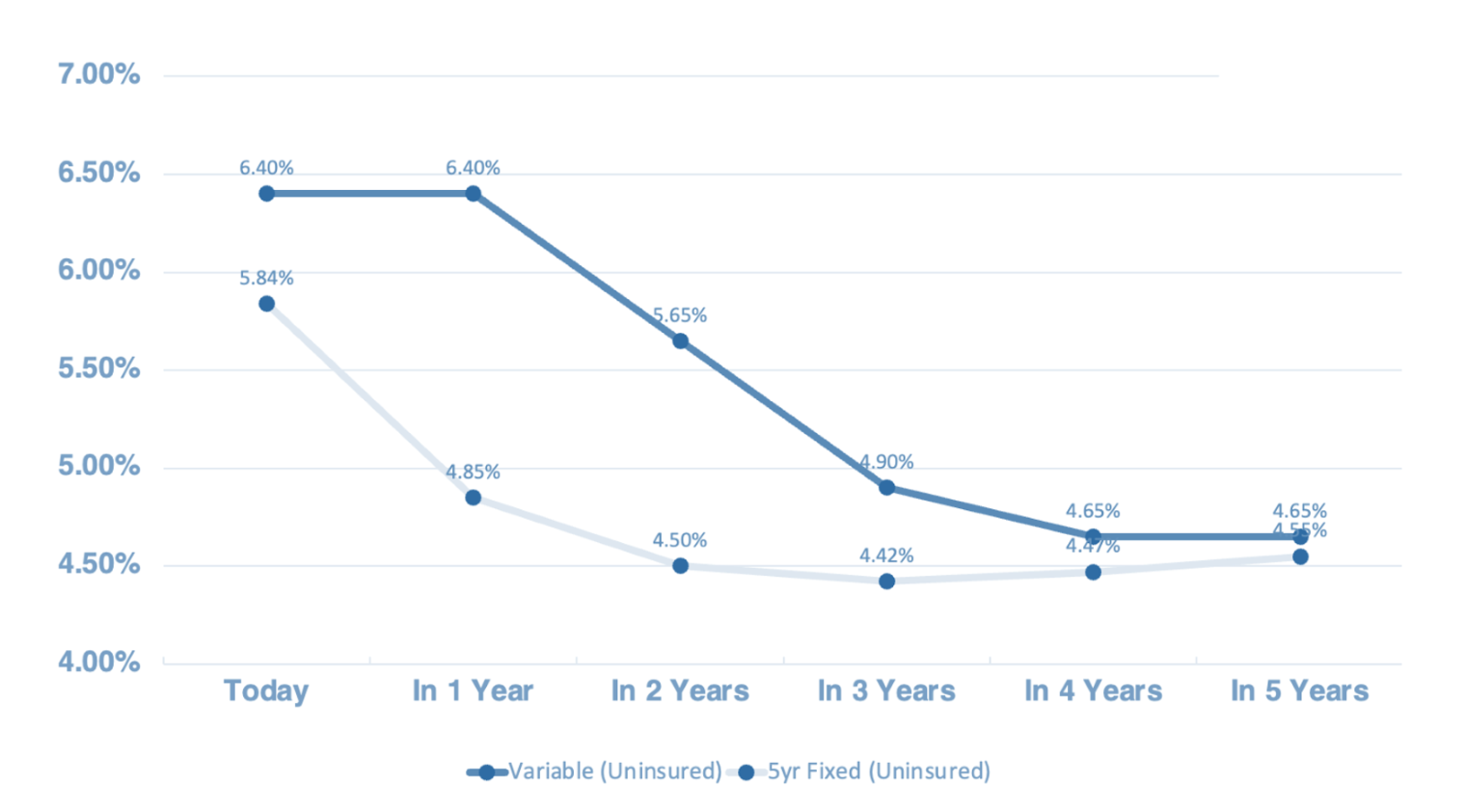

Mortgage Rate Forecast

5-year Fixed & Variable (Forecast)

*market predictions based on current data (subject to change).

Higher rates can linger longer despite optimistic predictions.

Next BoC Rate Announcement: September 6, 2023

Market implied chance of (25bpt) hike next BoC meeting: 25%

Market implied chance of (25bpt) hike by year end: 60%

Rate predictions are heavily influenced by Canada's job data.

Employment is poised to decline either naturally or through further BoC's rate hikes. Either way, the looming employment decline should temper future demand, therefore pushing bond yields (and fixed rates) lower.

Fixed or Variable?

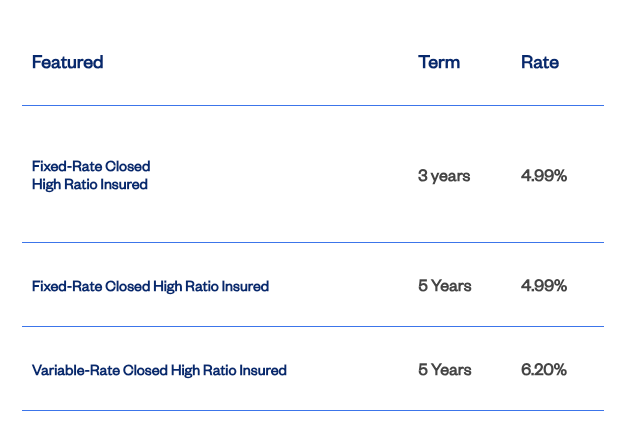

Note the fixed and variable rate predictions above. Based on the recent surge in fixed rates, watch for variable to outperform fixed as economic data further confirms a peaking rate cycle in Q4.

*except for products offered from select Nest Credit Unions, there are few lenders offering < 6% for conventional fixed terms.

If you are considering a new mortgage, would like to review your locking-in options, or simply have questions regarding your ongoing mortgage strategy, we would love to connect!