BoC Announcement 📢 | -0.50% Rate Cut Materializes

Who Knew?

🔮

As expected, or easily predicted, the Bank of Canada formally announced a 0.50% cut to the overnight rate earlier this morning. (click for official announcement)

This adjusts Prime Rate down to 5.95%, the lowest level we’ve seen in the past two years, and demonstrates a clear signal that the BoC is doing everything possible to kick-start economic growth.

A Green Light to Borrow

Governor Tiff Macklem’s message is straightforward: borrowing just got cheaper, and more cuts could be coming. With inflation settling back around the 2% target, he’s effectively giving Canadians the go-ahead to take advantage of lower rates, even if average core inflation is still a touch above the goal. "We want to see growth strengthen," Macklem said, and he’s determined to make it happen.

Sluggish Growth and Excess Capacity

The outlook for the economy remains bleak, with growth forecasts looking dim. Capital Economics, among others, sees a rough road ahead, predicting significant excess capacity well into 2025. This means more downward pressure on inflation, making today’s cut unlikely to be a one-off. David Rosenberg echoes this cautious sentiment, pointing out that Canada’s fiscal stimulus is far less robust compared to the U.S., and the impact of past rate hikes is hitting Canadian households harder—especially given the lack of 30-year fixed-rate mortgages.

What This Means for Mortgages

For mortgage holders, today’s big rate cut has immediate implications:

- Variable Rates: Those with floating-rate mortgages just got a bit of a break. The typical borrower with a $300,000 floating-rate mortgage will save over $120 a month—enough for some extra breathing room in the budget.

- Interest-Only HELOCs: Borrowers will see savings too—about $40 per month for every $100,000 borrowed.

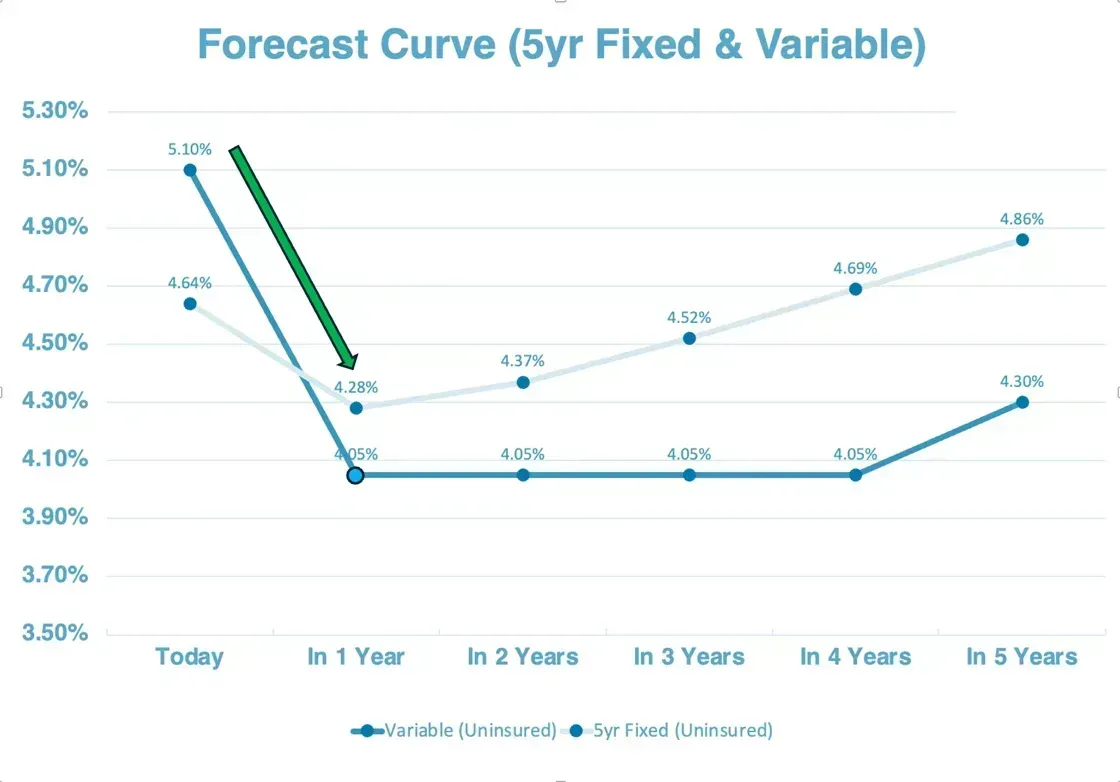

- Fixed Rates: Not much change in the near term, and further decreases will likely require a more significant economic downturn.

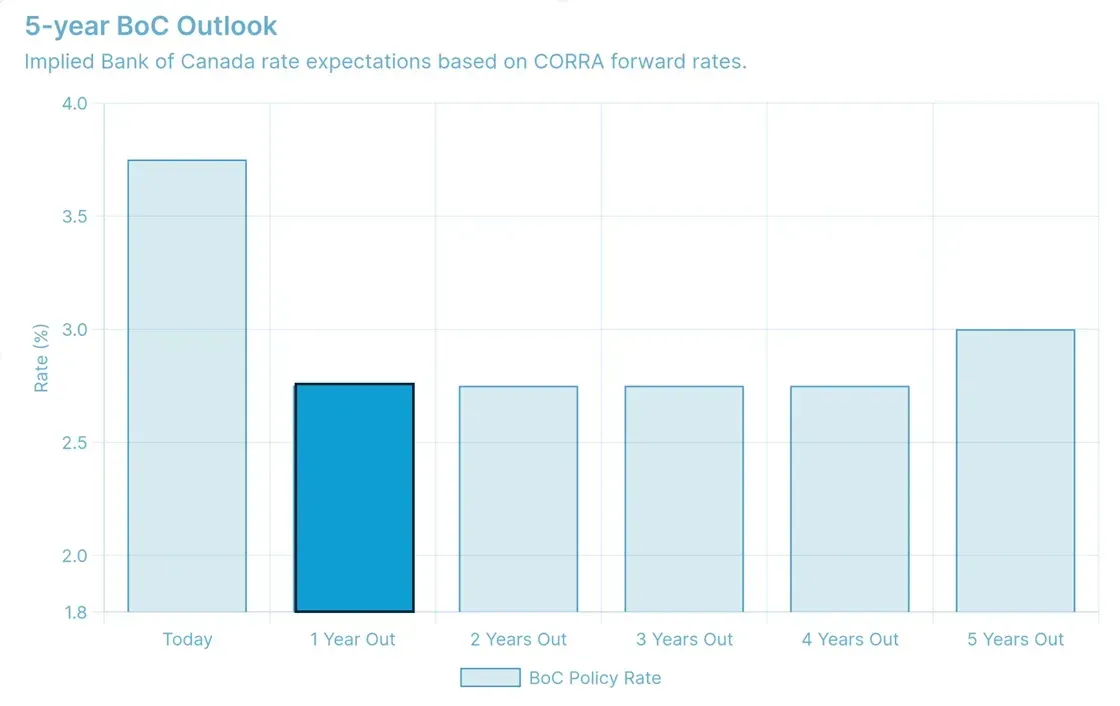

- Rate Predictions: The BoC’s neutral target suggests we might see the policy rate settle between 2.25% to 3.25%, with a floor for Prime Rate potentially around 4.95%. This puts a spotlight on a variable rate mortgage strategy as further cuts materialize.

Looking Ahead

While today’s cut is a boost for those holding variable-rate debt, it’s clear that the Canadian economy isn’t out of the woods yet. The Bank’s cautious optimism suggests further cuts in the pipeline, but for significant relief, both the Canadian and U.S. economies would need to show signs of greater strain. Until then, fixed-rates remain attractive for the risk-averse, while variable-rate borrowers stand to benefit the most from the current easing cycle.

The bottom line: it’s a great time to review your mortgage options, as the landscape is shifting, and staying ahead of rate changes could save you thousands over the life of your loan.