BoC Update | Less "STRESS" as loosening cycle continues!

Prime Rate will drop from 6.95% to 6.70%.

Given a 90% expectation of a rate drop heading into today's Bank Of Canada announcement, it came as no surprise that a second consecutive drop materialized. The Bank of Canada decreased its Key Interest Rate by 0.25% this morning, emphasizing a cautious approach to managing inflationary pressures and economic stability.

Today's rate drop mainly impacts variable interest products as Prime Rate will drop from 6.95% to 6.70%.

- Bond yields, directly correlated to fixed rates, notched down after the announcement. Yields currently sit 35bpts below recent highs, suggesting fixed rates may ease in the near term as well.

- Lower fixed and variable rates not only provide welcomed interest savings, but also enhance mortgage qualification (lowering the "Stress Test") for new mortgage applications.

Global Outlook: The global economy is expected to grow at around 3% annually through 2026. US and Europe are experiencing varied growth rates with inflation easing gradually. China's economy is showing modest growth amidst mixed domestic and export conditions.

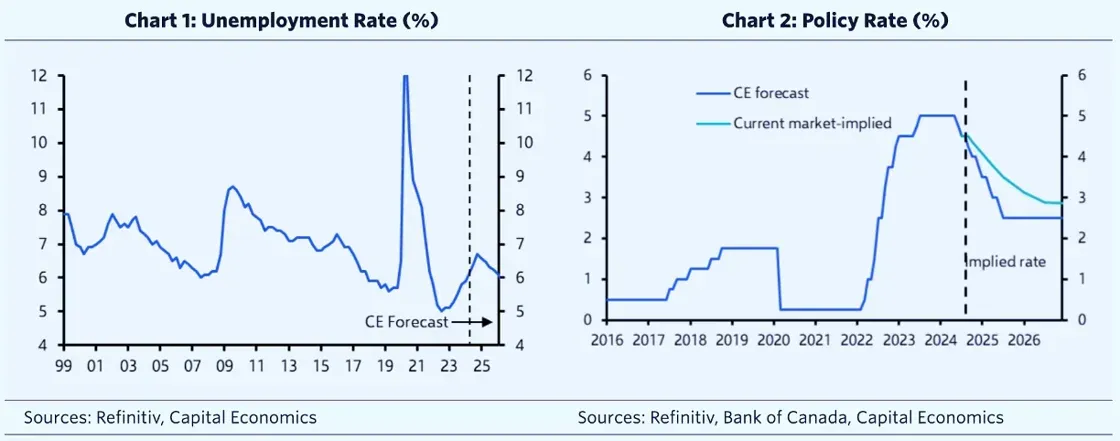

Canadian Outlook: Canadian GDP growth is estimated at 1.5% in the first half of 2024, below potential due to weak household spending and signs of labor market slack. Economic growth is expected to improve in the latter half of 2024 and into 2025, supported by stronger exports and easing borrowing costs.

Inflation Trends: CPI inflation moderated to 2.7% in June, with core inflation measures below 3%. Shelter costs remain a key driver of inflation, alongside services affected by wage increases. Inflation is expected to approach the 2% target as temporary factors affecting gasoline prices diminish.

Assuming softer GDP and employment reporting in August, and a US Fed rate cut in September (95% chance currently), the 52% market expectation of a September cut should push even higher.

Governor Macklem suggests a cautious "meeting-by-meeting" approach to managing economic stability, hinting that rates will need to move even lower to reignite the economy. Some analysts suggest we may see a 25bpt cut every meeting until the Bank’s neutral range is achieved (see Policy Rate chart above; forecasting 200bpts in further drops by 2025).

The next BoC Announcement is September 4, 2024.

________________________________________________________________________________________________________________________________________________________________________________

Stressed about your upcoming purchase, refinance, or renewal mortgage?

With the height of the recent rate cycle behind us, it is crucial to assess your mortgage strategy, specifically determining whether a fixed or floating mortgage product is right for you.

Let's schedule a call to tailor the perfect product strategy to meet your specific needs!