Final Bank of Canada Announcement of 2023

In light of the softening of the Canadian economy, the Bank of Canada opted to maintain its overnight rate for the fifth consecutive time earlier this month leaving Prime and variable product pricing unchanged.

While "financial conditions have eased," the Bank also highlighted persistent inflationary pressures stemming from ongoing wage growth and robust immigration. This is exacerbated by the housing supply failing to keep pace.

The Bank continues to emphasize the need for restrictive policy to bring inflation back within target, yet “the market” is no longer buying it!

With subdued core inflation pressures, declining GDP and house prices, and a softening labour market, it is inevitable that the Bank will need to reduce rates to avoid severe economic consequences. Market consensus is the rate-tightening cycle has passed and both new and existing mortgage holders can look to much needed rate reprieve in 2024.

- Bond yields have dipped more than -100bpts since October, leading to lower fixed rates.

- Conventional 5-year fixed rates are offered at 5.69-5.99%,

with a noteworthy offer of 4.99% for default-insured purchases. - As fixed rates have only dropped -50bpts over the same period, expect further discounting in the weeks ahead.

THE (MORGAGE) YEAR THAT WAS, AND WHAT LIES AHEAD?

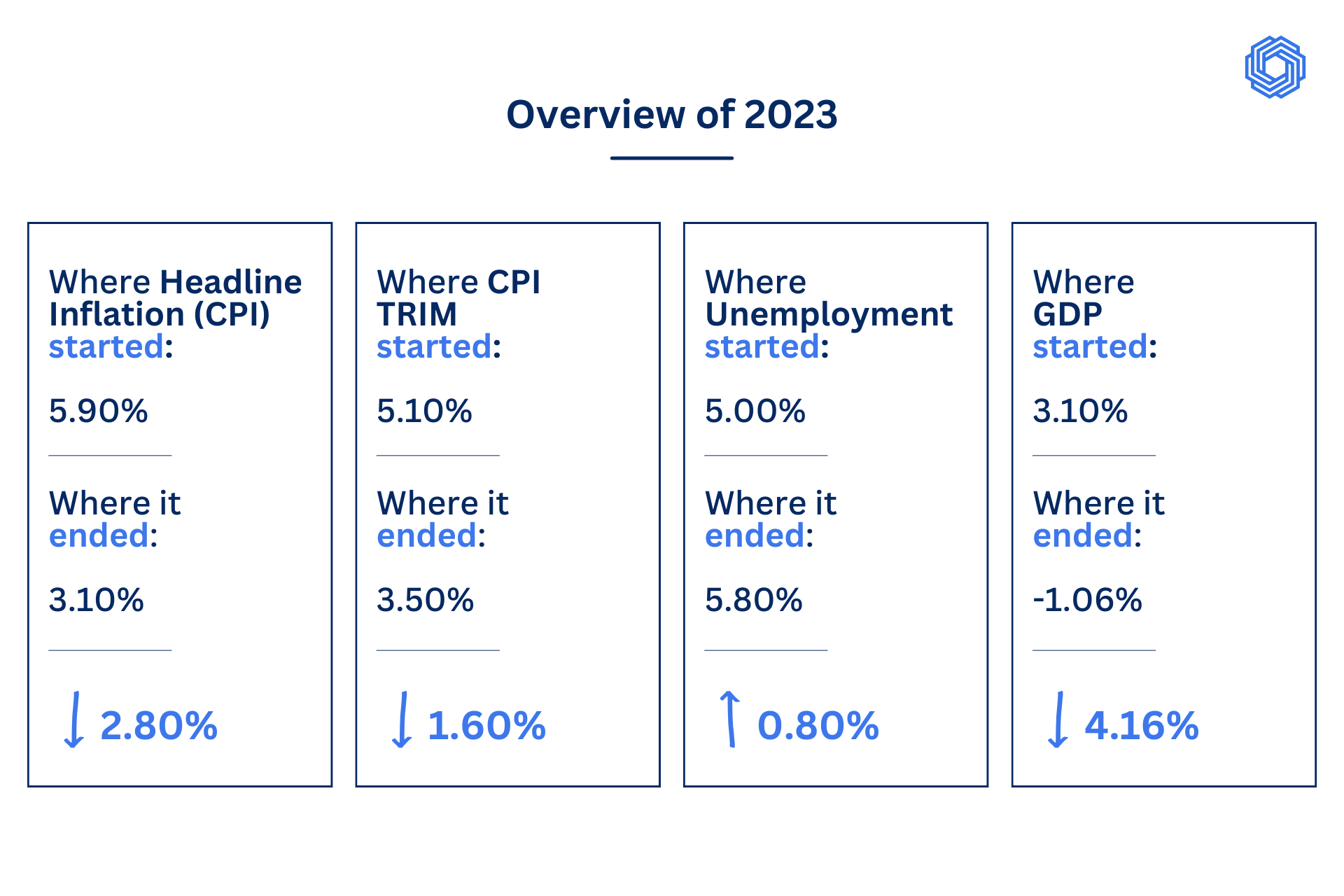

Reflecting on this past year it is important to highlight the key metrics closely monitored by the Bank of Canada: CPI, GDP, and Unemployment stats mentioned above suggest a favorable trajectory for interest rate relief.

Governor Tiff Macklem has shifted from his previously firm stance and recently indicated that the Bank does not need to wait for inflation to hit the target before easing rates. There is palpable concern regarding the impending wave of mortgage renewals and the potential impact on household budgets. Increased spending on mortgage payments is likely to curtail overall spending, thereby stalling economic growth and further negatively affecting GDP.

Analysts estimate roughly $251 billion in mortgages will come up for renewal in 2024, with another $352 billion renewing in 2025.

Recent remarks from the chair of the U.S. Federal Reserve, Jerome Powell, acknowledge the risk of holding rates too high for too long. The suggestion of three quarter-point cuts (-75bpts) to the US policy rate in 2024 aligns with a broader global trend of central banks reconsidering their stance on fiscal policy.

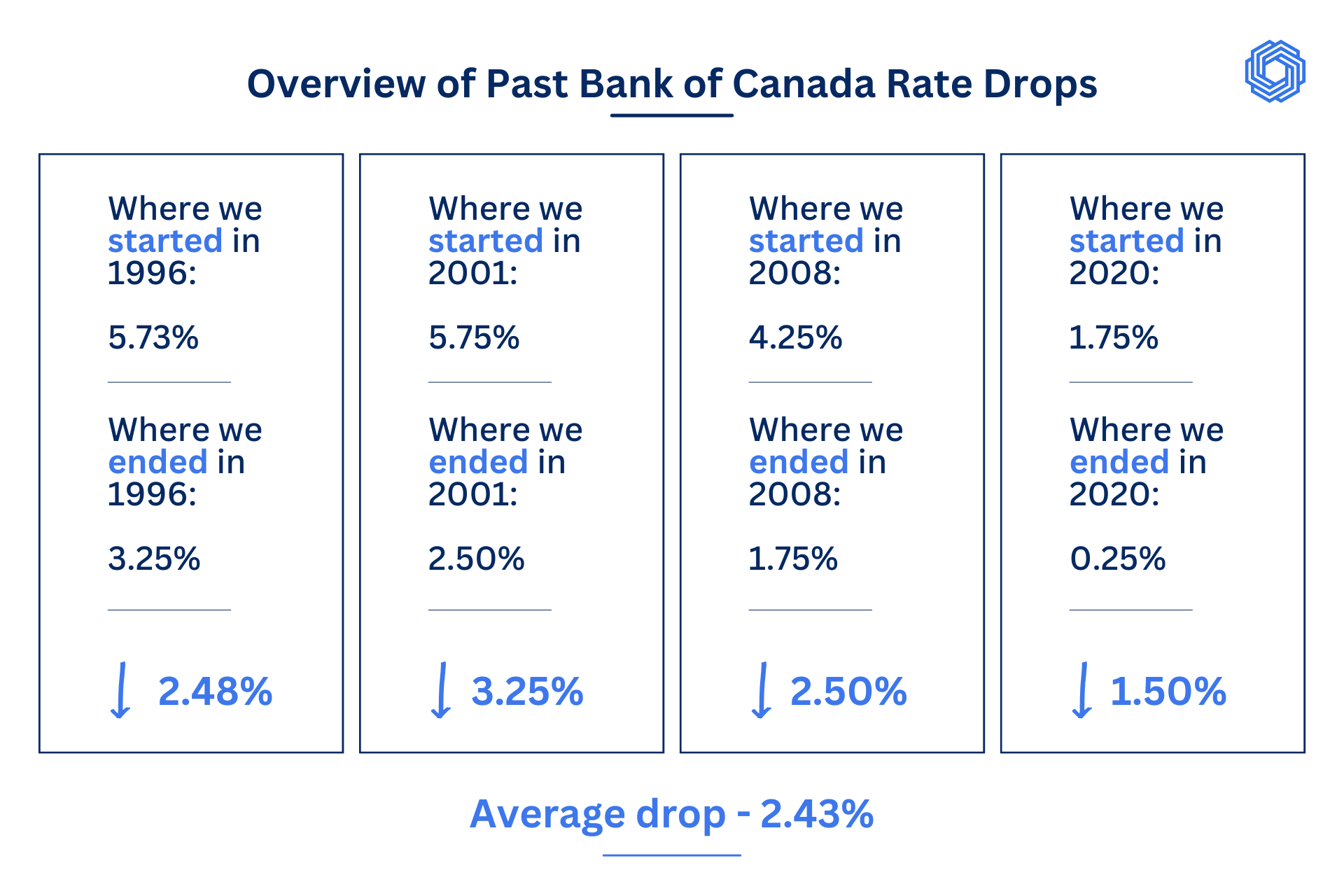

If previous "loosening cycles" serve as any indication, as seen in the four most recent cycles displayed above, forecasts from numerous experts suggest that the market's current pricing in of a 1% cut might be somewhat conservative:

- TD Economics: Predicts a 1.5% cut by the Bank of Canada in 2024, with cuts beginning in April.

- CIBC World Markets: Projects a 1.5% cut by the Bank of Canada in 2024, with cuts starting in May or June.

- Capital Economics: Anticipates at least a 2% cut by the Bank of Canada in 2024, with cuts commencing in March, and more to follow in 2025.

Historically the Bank has underestimated the depth and speed of rate easing necessary to avoid severe economic outcomes. The Bank is likely to shift rates out of the current restrictive territory (5%) and back to the higher end of the neutral range (2%-3%), with limited room for further decreases due to population growth fueling consumption and housing activity.

MORTGAGE STRATEGY RECOMMENDATION

While Bank of Canada rate cuts are all but inevitable, the precise timing and extent remain uncertain. Weak economic performance may justify aggressive 200bpt rate cuts, or potentially even more. The Bank's ability to implement aggressive cuts will be contingent on market response, especially in the housing sector.

- A strong majority of Nest mortgage holders polled shared they would select a variable rate mortgage over fixed if they had to choose today.

- Borrowers who recently chose a higher fixed-rate mortgage are now inquiring whether it makes sense to break their mortgage, incurring a small 3-month penalty today as opposed to a larger IRD penalty in 2024.

If you are considering the best course of action for your new or existing mortgage, it is paramount that you consult with your Nest Mortgage Advisor.

We will meticulously analyze your unique financial goals, curate a plan

tailored to your needs, and guide you through a mortgage strategy

designed to succeed over the long term.

We wish you all the best over the holiday season, and we look forward to connecting with you in 2024 or even sooner!

The information provided in this newsletter is for general informational purposes only. The views, opinions, and predictions expressed herein are solely those of the writer. Nest Mortgage encourages its readers to carefully evaluate their personal financial situation and risk tolerance before embarking on mortgage decisions.