BoC Update | Insights on Rate Easing

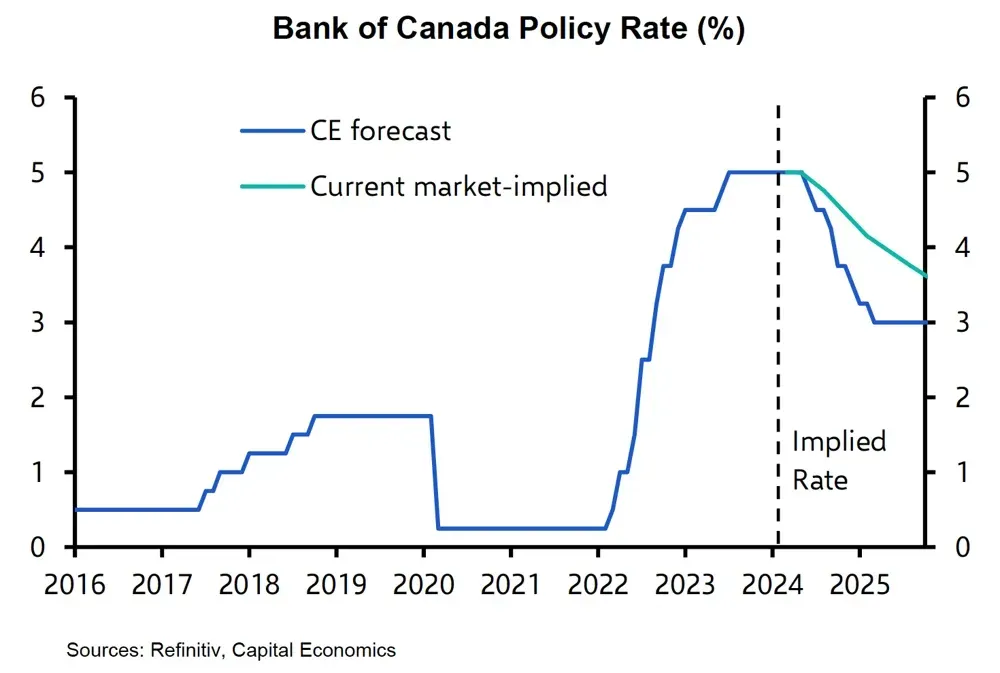

As anticipated, this week's Bank of Canada announcement kept the overnight rate unchanged. The Bank expects inflation to hover around 3% and drop below 2.50% later this year, aiming to reach the target of 2% by 2025.

Wednesday marked the sixth consecutive "no change" announcement, although speculation persists that we should see rates, specifically Prime, drop by .75-1.00% by the end of 2024.

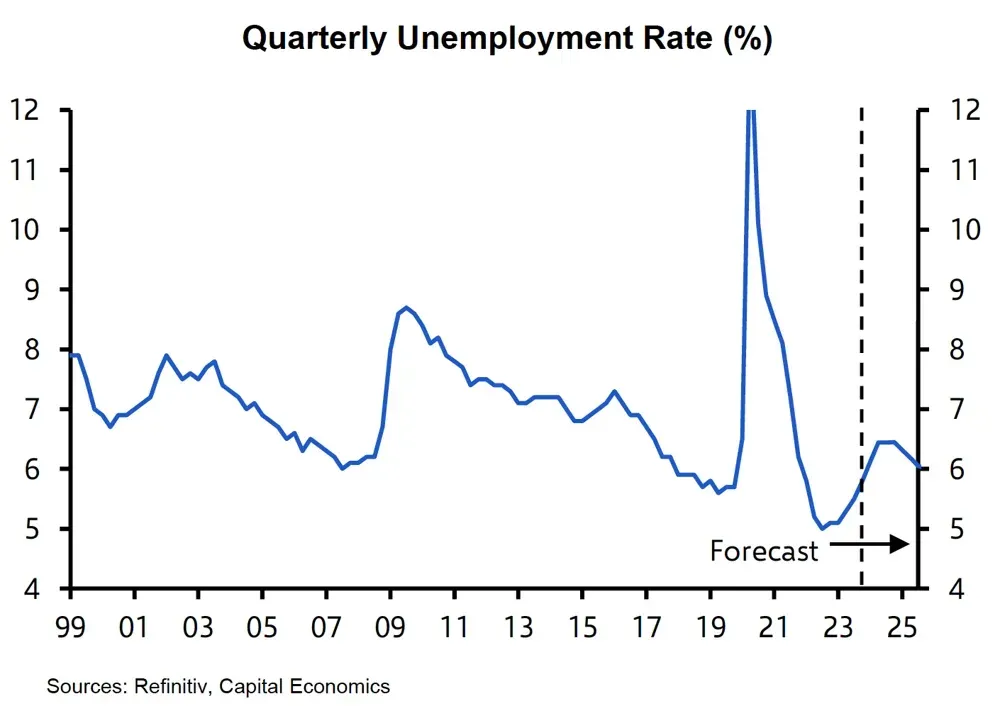

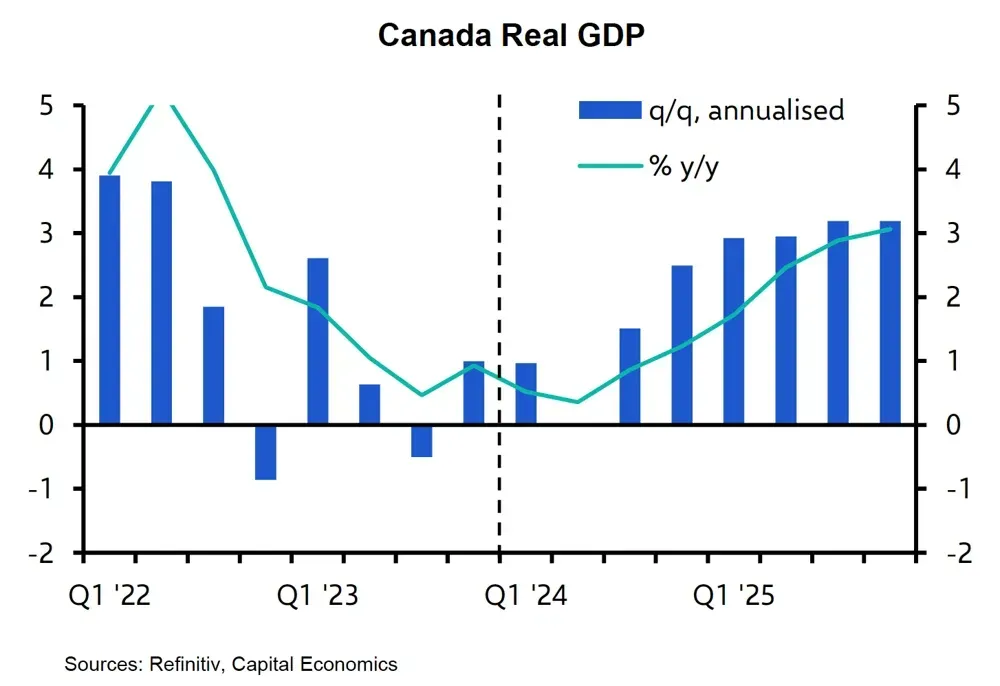

Despite no movement being widely anticipated, it is disappointing that further insight into a housing market reset has now been postponed until the next scheduled decision on June 5th. With unemployment at a 26-month high and GDP underperforming, these are two indicators contradicting the notion of rates remaining "higher for longer".

If you’re eagerly awaiting rate cuts and financial relief, Canada's economic landscape is painting a promising picture. The trajectory ahead appears to be downward; it's simply a matter of timing.

Considering a mortgage soon? (Purchase, Refinance, or Renewal?)

As mentioned, some experts still suggest variable and adjustable rates could plummet by up to 1.25% by the conclusion of 2024. In contrast, bond yields and Fixed rates have faced upward pressure as of late, highlighting the importance of connecting with Nest and formalizing a mortgage pre-approval to guard against near-term rate bumps.

Monthly payments getting you down?

In many cases, mortgage interest rates are significantly lower than unsecured rates such as those on credit cards, auto loans, and lines of credit. Consider exploring debt consolidation through a Refinance as a potential solution to create some much-needed monthly payment relief.

Approaching Mortgage Renewal?

If concerns are rising regarding higher rates upon renewal, now is the perfect time to assess your mortgage strategy. Rest assured, we are dedicated to keeping up with the dynamic mortgage market and uncovering opportunities that suit your specific needs.