June 19th, 2024 by Ray Macklem

Why Rates will definitely...probably...maybe Fall Faster and Farther than Expected

Will Rates Actually Take the Stairs Down?

June 5th, 2024. That's the answer to the question everyone has been asking for a very long time. When is the Bank of Canada (BoC) going to start lowering interest rates? But no sooner does that question get answered do we move on to the next questions: When's the next one? How far down does it go? When and where do they end?

The overarching caveat is that nobody really knows and a lot of this will be 'data dependent'. But we all want opinions and projections. So let's give the people what they want. This might be a little longer than usual but stick with me. I hope you'll find more than a few nuggets in here that will help you out.

There are probably more than a few that are reading this and saying 'well he's already wrong' for one of two reasons (or maybe both)

- Rates take the elevator up and the stairs down

- The BoC can't deviate from the Fed so we're stuck with higher rates

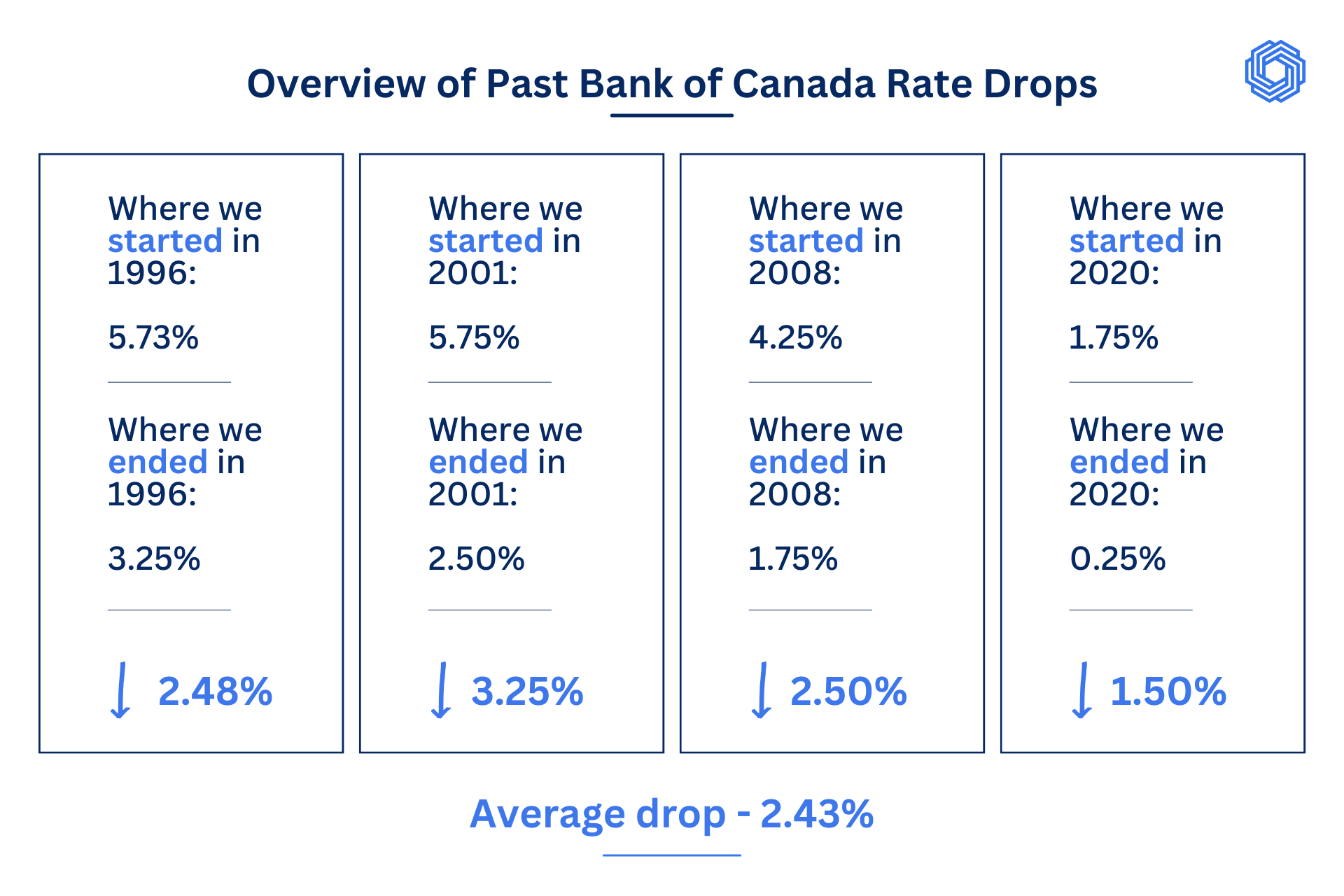

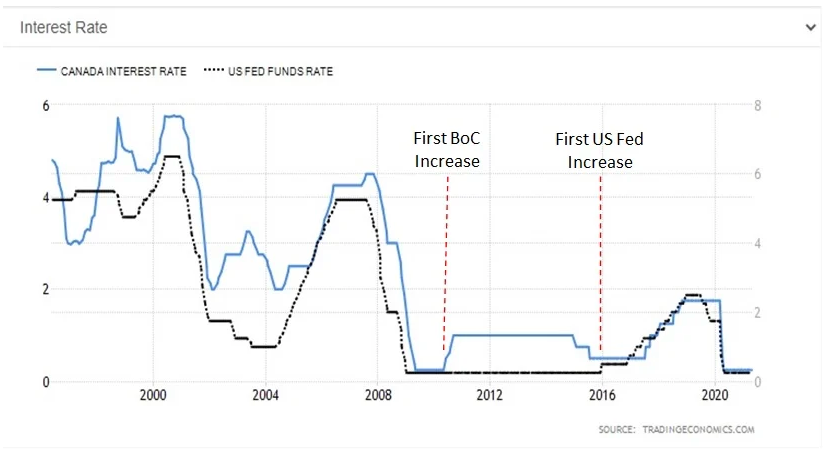

To those points, I would counter you by saying 'nuh-uuuuhhhh!!!'. If past history is any indication of future results, both of those objections have been proven wrong historically. Which isn't to say that they'll be wrong again. But we repeat them as fact and often without context. The BoC has cut rates quickly in the past. As in ~2.5% or more within 12 months in 3 of the last 4 rate cut cycles (see image below). And though long term deviations from the Fed aren't ideal for our currency and the economy as a whole, the graph below shows that there have been multiple occasions where policy rates between the Fed and BoC have diverged temporarily. And remember - the job of the BoC is focused entirely on inflation. So foreign exchange rates only matter in so far as they impact inflation at home. And ForEx markets have already shifted given expectations of deviation so at least some that effect is already baked into to current exchange rates. If given the choice between protecting the Canadian Consumer or the value of the Canadian Currency abroad, the BoC will always choose the Canadian Consumer.

Make no mistake: We are in a Recession.

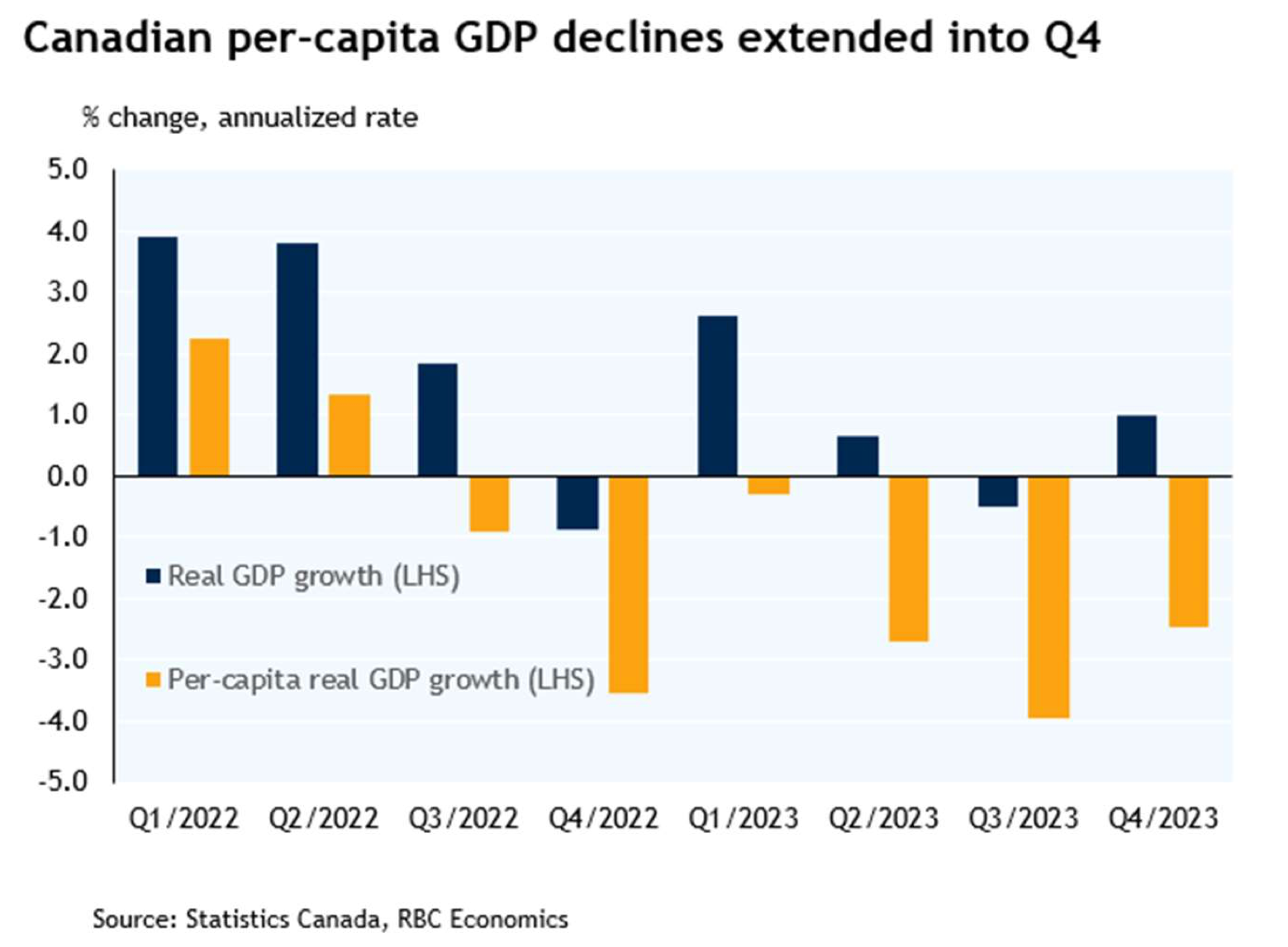

The Canadian economy is in a per-capita recession. In six of the last seven quarters, real GDP per capita has been negative. The challenge is that record population growth have provided a smokescreen. Where first-quarter GDP clocked in at a not-so-bad 1.7% - real GDP per capita tipped the scales at -2.0%!!! So though the economy is 'growing' in total terms, we're actually getting worse off on a per-person basis. That's not reflective of an economy that needs restrictive rate policies.

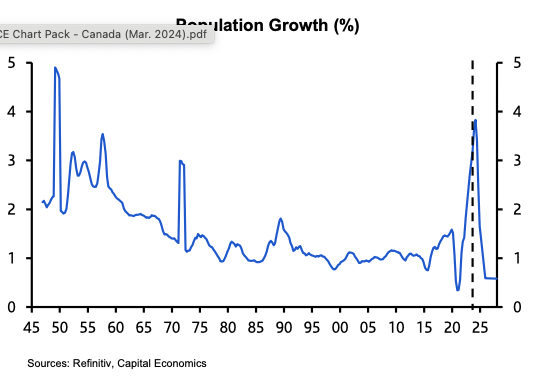

Population Growth will Swing by 1,000,000

So if record population growth has skewed aggregate stats like consumption, GDP and inflation, what happens when that goes away? Well, we're about to find out. The Federal Government announced a cap on Temporary Residents of 5% of the Canadian population starting in September. Capital Economics estimates that Temporary Residents represent roughly 7.5% of Canadians. To achieve that 5% target over the next 3 years, we'll have to see the net increase of new Canadians shrink to roughly 250,000 per year. Or to put it another way, the primary driver of consumption, growth and inflation is about to get a kick in the teeth. And if it took record population growth to achieve what are now rather mundane numbers, without it, underlying economic weakness is about to become exposed.

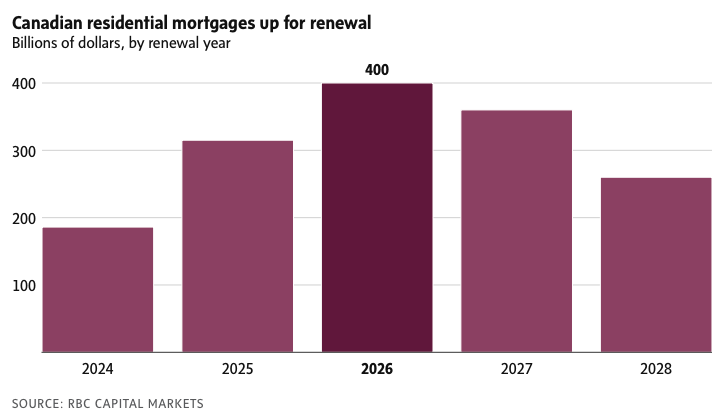

76% of all Canadian Mortgages to Renew by 2026

High interest rates increase borrowing costs which in turn takes a bite out the amount of money Canadians have to consume. Demand is reduced. Supply gets a chance to recover. Prices normalize. That's the entire premise of what we've seen over the last ~2 years. But a solid proportion (over 60% according to Edge Realty Analytics) of Canadian mortgage holders have yet to feel this pain.

If the BoC were to do nothing more, the effect of the "Mortgage Renewal Cliff" would be an additional and significant drag on Canadian's ability to spend and drive the economy. Given higher rates have already done the heavy lifting, additional drag is not what the Canadian economy needs.

The Rest of 2024...

If I had to characterize the current market, it kinda feels like everyone is standing around the pool waiting for the first few to jump first. Home buyers are ready and eager, but many aren't feeling brave enough quite yet. They will want to see another rate cut or two and how the market responds before taking the plunge themselves. And they will get their rate cuts. Current market pricing sees 2 more rate cuts in 2024 (September and December) as well as 4 more in 2025 (1 in each quarter). That would leave the overnight rate at 3.25%. But given what I've outlined above, that starts to feel pretty conservative.

Market pricing aside - many experts (RBC, CIBC, Capital Economics) are projecting 3 more rate cuts to finish 2024 with more to follow in 2025. Those cuts will increase market confidence, improve affordability and increase demand. We're clearly not going back to 2021 rates but given where Canada is currently sitting, relief is very likely needed sooner rather than later. And if that ends up being what happens, the window of opportunity for buyers will be closing in the near future.

Preparation will be key as the market evolves. It's never been more important to connect with trusted mortgage advisor to work out a strategy that fits borrowers specific needs. And we want to be your trusted mortgage advisor! So if you see the value in how we approach the market and advise, let's connect. And if you have any questions or want to discuss any of the content above, please reach out! I'm always happy to hear different perspectives.

All the best out there!